More ways to connect with your money

We get it. You and your money are on the move. So are SPC’s mobile banking & e-services! Use these FREE services to stay connected with your money no matter wherever life leads you, whenever it leads you there!

Mobile Services

Have phone, will travel! Transform your mobile device into your personal mobile banking assistant with these easy-to-use apps. Business Members: that goes for you, too! Check out our For Businesses to find out about your mobile and online banking options! Reach out to us to learn more about what services are available to you!

-

SPC Mobile Banking App

The SPC Mobile Banking app is a FREE, secure online banking application that gives you 24/7 access to your account information. Download on the App Store (for Apple Products) or Google Play (for Android) and log in using your Online Banking Credentials to use these features:

- Deposit a check or make a payment anytime, anywhere with Mobile Deposit

- Please note: First-time Mobile Deposit users must enroll for this functionality through SPC Online Banking in the mobile banking app.

- Click on the video below to see for yourself how to make a mobile deposit!

- Set and change your password, security questions, and personal information

- View account balances and details for savings, checking, certificates, and loans

- View funds on hold for savings and checking

- View pending ACH transactions and even authorize early deposits with ACH On-Demand

- View your Secure Message Center

- Perform instant transfers between accounts

- Pay bills

- Apply for a loan

- View check images

- Pay a Loan using LoanPay Xpress

- Use Card Controls to temporarily lock/unlock your card, enable push notifications for card usage alerts, and report lost/stolen cards

Once your Mobile Banking App is set up, you’ll have the option of using PIN, facial, voice, thumbprint recognition, or a standard username and password to log in.

Need more information about the SPC Mobile Banking App? Contact us via phone at (843) 332-4506 or via email at inquiries@spccu.org, and we’ll set you up with a temporary login right away!

- Deposit a check or make a payment anytime, anywhere with Mobile Deposit

-

Contactless Tap-to-Pay

Your SPC Mastercard Credit & Debit Card now features Contactless Tap-to-Pay technology! Simply hold your card over the card reader for contactless payments without the need to insert or swipe your card. Contactless Tap-to-Pay technology offers a safer, speedier, and smoother payment process.

-

Mobile Wallets

Have phone? Will purchase! Gone are the days of clunky wallets taking up way too much room in your pocket or purse. Do yourself a favor and load your card into your device’s mobile wallet to make purchases easier, safer, and more convenient than ever. Take your SPC Debit &/or Credit Card with you wherever you take your mobile phone using Apple Pay or Google Pay. Keep reading and visit the links below for more details on how to use your SPC Debit or Credit Card with your device’s mobile wallet!

Apple Pay is the safer, more private way to pay with your SPC Debit or Credit Card on your iPhone, Apple Watch, iPad, or MacBook Pro with Touch ID. When you make a purchase, Apple Pay uses a device-specific number and a unique transaction code. Your full card number is never stored on your device or on Apple servers, and it can’t be shared with merchants. Apple Pay doesn’t keep transaction information that can be tied back to you, ensuring all purchases are private. Click here to watch a quick video to learn how to set up your card in your Apple Wallet.

Google Pay is the faster, safer, easier way to pay in stores with the Google Pay icon, online wherever you see the Buy with Google Pay button, and using autofill on Android and Chrome. You can even send money to friends through your Google Account, using only email. Click here to watch a quick video to learn how to add your SPC Debit or Credit Card in your Google Wallet.

-

SPC Phone Banking

Did you know easier account access is just a dial away? That’s right! You can have direct access to your SPC Credit Union accounts with just one phone call!

SPC Phone Banking is a bank-by-phone system that makes taking care of your credit union business faster, easier, and safer! It’s a win-win-win!

SPC Phone Banking lets you perform numerous transactions, including:

- Reviewing account balances

- Verifying the date and amount of your transactions, including deposits, withdrawals, transfers, & payments

- Verifying whether certain checks have cleared

- Transferring funds within their own account suffixes

- Making loan payments

- Checking current rates

- Changing your Personal Identification Number (PIN)

- Obtaining annual dividend and interest information

- Whether you’re at home, at work, or thousands of miles away, SPC Phone Banking puts your accounts right at your fingertips

**UPDATE (9/2/22): In an increased effort to ensure the highest levels of security, SPC Phone Banking (audio, not Mobile App) has removed the ability to perform inter-member transfers and check withdrawals via audio banking. Members may still transfer within their own account suffixes.

Want to sign up? Follow these instructions!

- Call (843) 332-4506

- Press 1 for SPC Phone Banking

- Enter your member number, then press pound (#)

- Enter your temporary PIN (the last four digits of the Primary Account holder’s Social Security number), then press pound (#)

- You will be prompted to enter a new PIN, then press pound (#)

- Confirm your new PIN

-

SPC Text Banking

Text banking puts your two thumbs in charge of your on-the-go banking experience. Use text banking to:

- Send a text command and receive replies for account balances

- Enroll in e-Alerts to be notified of your balances, when electronic deposits or withdrawals are made, or when a payment is due

How to Enroll in Text Banking:

- Log in to SPC Online Banking at spccu.org

- Click the “Go Mobile” button on the toolbar

- Select Text Banking Home

- Follow the prompts to enroll

- After enrollment, text commands to IM247 (46247)

One-Way Text Alerts

You can set up one-way text alerts via the e-Alert Subscriptions page and create alerts similar to your standard e-Alerts, such as:

- Account Balance

- Notification of an ACH deposit or withdrawal

- Daily balance notification

- Daily notification showing total dollar amount of transactions

- Daily notification showing total number of transactions

- Notification that a Loan Payment is due

- E-Notice notifications

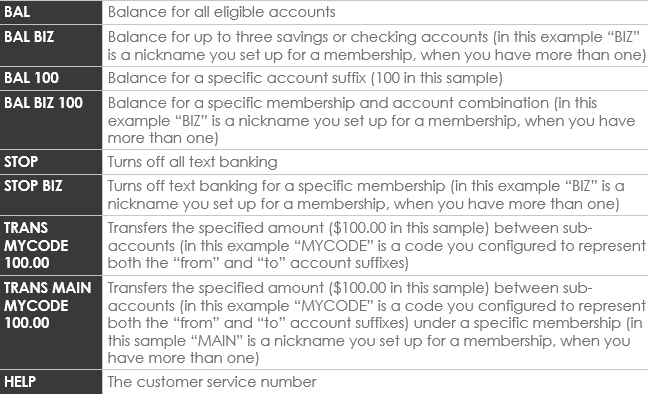

Text Banking Commands

Check out the chart below for Text Banking command examples and their responses. You can also access a list of these commands via a link in online banking during the Text Banking enrollment process. These commands can be sent to IM247 (46247).

-

Fraud Text & Email Alerts

Fraud text & email alerts make it easy for you to respond to suspicious transaction activity on your SPC Credit and Debit Cards swiftly and easily. If our fraud monitoring service detects something fishy, you’ll receive an SMS/text message or email alerting you of the transaction. Learn more below!

- Do I have to enroll in fraud text and email alerts?

- No. You're automatically enrolled with the phone number on file with SPC Credit Union. If there is no reply to the text, then an email will be sent. If there is no reply to the email, then a call will be made to the mobile number, then the home number.

- What will the text message look like?

- The text message includes the following transaction details: date, last four digits of card, dollar amount, merchant name, and location.

- What should I do if the transaction was mine?

- If the transaction in question is legitimate, you should simply reply "YES." You will receive a response that confirms this action taken.

- What should I do if the transaction was not mine?

- If you did not make the transaction in question, you should simply reply "NO." You will receive a response that confirms this action taken.

- What if I need additional help?

- If you need additional help, simply respond "HELP" and you will be directed to the Card Member Security Team. You will receive a response that confirms this action taken.

- What if I choose to opt out?

- If you reply "STOP" via text, you will be opted out of text notifications. You will still receive calls from an automated assistant if you opt out of text notifications.

- How do I opt back in to text message notifications if I've previously opted out?

- To opt back into text notifications, call Card Member Security at 888-241-2510 or email falcon.supervisor@coop.org.

- What will email notifications look like?

- Email fraud alerts will reference the cardholder by name, as well as the last four digits of the card. The email will also include a brief description of why the fraud alert team is attempting to contact the cardholder. Transaction details will include merchant name, amount, date, time, location, and status. Status options include approved, denied, and attempted. Transactions which prompted the inquiry will be included. A maximum of five transactions will be shown. Following the transaction information, the cardholder will be asked to confirm if they authorized the transactions. Two options with clickable links are included. The "All Transactions Authorized" link validates the transaction(s). The "One or More Transactions NOT Authorized" link confirms that one or more of the transactions are not recognized by the cardholder.

- What happens once I click the authorization links via email?

- If the cardholder clicks the "All Transactions Authorized" link, they will receive an email response confirming this action taken. If the cardholder clicks the "One or More Transactions NOT Authorized" link, they will receive a different email confirming this action taken. Additionally, the card in question will be blocked. The cardholder should contact Card Member Security as soon as possible.

E-Services

Where there’s a Wi-Fi connection, there’s a way…to BANK with us, that is! Browse these online tools that are sure to make your banking experience feels Safe. Personal. and Connected.

-

CONNECTExpress ITMs

Experience a new level of convenience and connection with an SPC Credit Union CONNECTEXPRESS ITM(Interactive Teller Machine): looks like an ATM, acts like a teller. Pull right up and be the boss of your own banking experience—whenever it’s convenient for you. Visit any SPC branch to use the 24/7 CONNECTEXPRESS ITMs to:

- Deposit cash/checks

- Withdrawal cash

- Cash checks

- Make loan payments

- Transfer money

- AND speak with an SPC Associate (during regular business hours)

Click here to watch a quick video featuring the benefits of using a CONNECTExpress ITM!

-

Online Banking

Online Banking gives you the freedom to bank online WHEN and HOW you want. It’s online banking designed with YOU in mind!

Use Online Banking to view all your account information online–from savings and checking accounts to certificates, loans, and credit card accounts. You can even see images of canceled checks with a click of the mouse, and you can give your accounts “nicknames” to make it easier to keep track of them!

Online Banking offers these features & more:

- View account balances, histories, & status

- Access SPC Bill Pay

- View check copies

- View pending ACH transactions & authorize early deposits with ACH On-Demand

- Request stop payments or account updates, including mailing and billing addresses, phone numbers, & email addresses

- Find tax & paid dividends/interest information

- View e-Statements

- Perform or schedule fund transfers

To get started using Online Banking, click on the "Online Banking" box toward the top left-hand side of the page, and follow the steps below:

Username:

For all users, your username/login will be your SPC member number. After you’ve set up your account, you’ll have the option to create a new username if you choose.Passwords:

For all users, the eight-digit password will be the last four digits of the PRIMARY member's Social Security number and four-digit birth year. You will be prompted to create a new password after you log in for the first time; that will be your password going forward.Troubleshooting your Online Banking login:

If you have already set up a new username for your Online Banking account, you will no longer be able to use your account number to log in. If you have forgotten your username or have been locked out of your account after too many failed attempts to log in, you’ll need to contact an SPC Associate at (843) 332-4506 or email us at inquiries@spccu.org. -

SPC Bill Pay

Managing your finances is easier than ever with SPC Bill Pay in SPC Online Banking or the SPC Mobile Banking App! Manage all your bills in one location: no more envelopes, stamps, or trips to the post office.

Your upgraded SPC Bill Pay dashboard allows you to view payees, upcoming bills, payment history, and account balances at a glance. Plus, you can make a payment with just one click from your dashboard. Here’s how easy it is:

- Click the SPC Bill Pay tab in Online Banking or SPC Mobile Banking to access the Bill Pay home page dashboard

- Find your payee

- Enter the payment amount & date

- Click “Submit”

If you need to add a new payee, just select the “Add a Payee” button at the top of your dashboard. For more information about adding payees and scheduling payments, go to the “Help” tab in Bill Pay.

-

E-Statements

Eliminate the clutter and hassle of paper statements by signing up for SPC e-Statements! With e-Statement access, you can view a copy of your monthly statement ANY time on SPC Online Banking. To sign up for SPC e-Statements, simply login to SPC Online Banking and choose the e-Statements tab.

Extensive security precautions have been taken to ensure confidentiality. Not only can you use e-Statements to reconcile your checkbook, but you can view copies of checks cleared at no charge! Statement history is stored electronically up to 18 months.

-

MoneyMap Budgeting Tool

MoneyMap is your personal budgeting and financial management tool that connects with SPC Online Banking and the SPC Mobile App to bring ALL of your financial information—including your SPC account, other bank or credit union accounts, investment firms, credit cards, and loans–under one roof. Try it out today to tap into tons of tools, resources, and integrations that’ll make you feel like a financial whiz. Here are just a few of the features you’ll find on MoneyMap (in Online Banking & the SPC Mobile App):

- View Accounts: MoneyMap’s aggregation tool takes all of your account balances from SPC and other financial institutions and puts them in one place to make it easy to see the full picture of your finances.

- Bubble Budgeting: “Bubbles” illustrate various categories in your budget to help you quickly identify the areas where you spend the most.

- Track Spending: With MoneyMap’s expense tracking feature, you’re not just tracking spending–you’re getting to know and understand your financial habits through automatic expense categorization.

- Debt Management: Create a custom financial plan that fits your lifestyle so you can stay on track with your budget and take the right steps to reduce debt. This tool gives you step-by-step instructions on how to get out of debt using visualizations that help you to better understand your debt and how it’s being paid down.

- Net Worth Tracking: A closer comparison of your finances in terms of assets & liabilities will help you understand if you’re moving in the right direction toward your goals–from saving for retirement to paying down debt!

"I have been a member for over 30 years and I have always felt at home here. The employees always take care of my needs and I would not think of going anywhere else." -Barney

"They're always wonderful to me and accommodate to the best they can." -Anna

"I hope and pray that this level of customer service continues to be there, because these two ladies definitely went the extra mile." -SPC Member

"I have been a SPCCU Member for years and I have never had any problems doing business. They have helped me improve my credit and I am thankful." -SPC Member

"I love using the SPC App! It's so easy and convenient! From checking my balance at any time to even getting my paycheck a day early, SPC has the best features I've seen at any credit union/bank." -SPC Member